![]() Update: e(RINGLE) has incorporated my algorithm into his P3 for Empire Avenue Chrome extension. Use his extension instead of mine, because it includes what I built and much more! If you already installed mine, be sure to uninstall it before installing P3, or some weird things can happen.

Update: e(RINGLE) has incorporated my algorithm into his P3 for Empire Avenue Chrome extension. Use his extension instead of mine, because it includes what I built and much more! If you already installed mine, be sure to uninstall it before installing P3, or some weird things can happen.

Recently, I started playing in a fantasy social media stock exchange, called Empire Avenue. It took me a while to get a handle on what moves the prices, and I’m still learning. With some help from Chris Pirillo, I think I’ve finally got a good handle on it and he’s helped me start a tool that can help you build a sound Empire Avenue portfolio too.

I first came to learn about Empire Avenue when Jesse Stay made a few blog posts about it where he writes about Empire Avenue as a catalyst for the new economy and the new frontier of capitalism. Both articles were excellent, but my interest hadn’t quite piqued until my good friend Bwana posted his thoughts on Empire Avenue and he referred me to Chris Pirillo’s tips on Empire Avenue.

Two Ways to Make Eaves

Eaves are the Empire Avenue (virtual) currency. Being a numbers guy and with data analysis being my day job, I wanted to learn how to play the Empire Avenue exchange. I figured I could probably put together some tools to earn some virtual money, just as I did in Urban Rivals.

When it comes down to it, there are two ways to make Eaves in Empire Avenue with your investments:

- By earning dividends from what I will henceforth refer to as stocks (which are actually people or companies – i.e. entities with social networking accounts)

- By buying stocks for a low price and selling at a higher price

Fundamentally speaking it’s pretty simple, but in order to determine what constitutes a good investment, you need to learn what drives both dividends and stock prices. It became very clear to me when Chris Pirillo told me:

- Stock price = buying interest from others

- Dividends = your (social networking) activity (both on and off-site)

Dividend Yield

Chris Pirillo’s strategy is to identify stocks that provide a high dividend, relative to the stock price. I like this strategy very much, because it is quite conservative. If you find a good dividend producer, the stock price could remain stagnant or even drop, and you still make money. While you own the stock, you will continue to earn daily dividends, which come from the daily social networking activities of the person/company.

This strategy also applies to real stock exchanges, where investors might purchase a stock that has an attractive dividend yield. Dividend yield is calculated by dividing the dividends paid per share by the stock price. It’s a good measure to use to decide whether or not a stock might be a good investment, in terms of the dividends it will provide relative to the purchase price of the stock.

Because I was attracted to Chris’ strategy of focusing on high dividend yielding stocks, I started developing my own Chrome Extension to provide some investment analysis on Empire Avenue stocks. Chris provided a great deal of help in developing the tool, with suggestions on what to add. In addition to providing dividend yields, it also provides break even information (which I will explain in a bit) as well as current profitability info for the stocks you currently own.

Capital Appreciation

Just as one might buy real life stocks low and sell high, that same concept applies to Empire Avenue. In real life stock markets, this is referred to as capital appreciation. You can certainly use dividend yield to decide whether or not a stock is still relatively inexpensive compared to the dividends it provides. Chris also uses this as an indicator for whether or not a stock has room to grow in price.

I think this is a decent strategy as well, however, I would not rely on it alone. The price of a stock is driven by the demand to buy it. If a lot of people want to buy it, the stock price will move up. By the same token, if the stock has appeared to plateau, it may drive individuals to sell it which in turn would drive the stock price down. The speculative nature of these ups and downs can make investing based on price alone somewhat risky.

Until more tools such as mine and Eddie Ringle’s (I will likely incorporate my calculations into his extension eventually, as he has his open sourced and posted to Git) come out and provide additional valuation metrics and analysis, there is also the human nature of thinking because the share price is high the stock is expensive, which is mistake many would-be investors make. One cannot value a stock as inexpensive or expensive based on share price alone. It must be placed into context with valuation metrics such as dividend yield.

For example, my stock e(GEEKLAD) is currently trading for 13.620 and Chris’ stock e(PIRILLO) is trading for 156.32. If you were to value our stocks on share price alone, you would say mine is cheap and Chris’ is expensive. However, if you used dividend yield to valuate our stocks, Chris’ could be considered much cheaper. His provides more than a 1% dividend yield, whereas mine does not even provide 0.50% dividend yield.

On the other hand, there is still that human factor where most individuals would have the tendency to say Chris’ stock is more expensive than mine, and I would suspect that at his current price his stock probably won’t appreciate as fast as mine. Also, because he has many more outstanding shares, it would take much more volume for his stock to move rapidly than it would take for my stock to move. As the outstanding shares increase, the relative volume will probably decrease, so you’ll see slower acceleration in the stock price.

My Chrome Extension

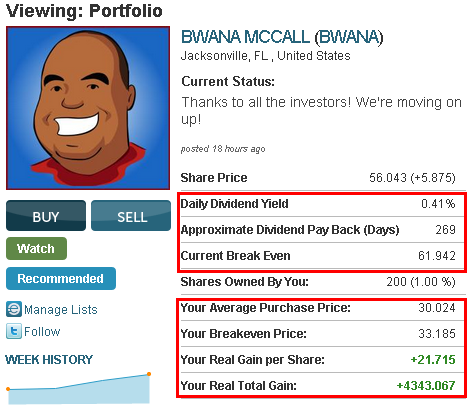

My plugin provides you with the following information when you either view a stock’s profile page (when you are logged into Empire Avenue):

- Daily Dividend Yield: This the calculation of the daily dividend per share divided by the share price. In Chris’ experience, 1% is a good yield, 2% is extremely good, and 3% is nearly unheard of.

- Approximate Dividend Pay Back (Days)This is how long it would take you to earn back the money you paid to buy the stock, and cover (an assumed) 5% commission as well as the 5% commission you would need to pay when you sell it.

- Current Break Even: This is the share price the stock would have to increase to, in order to cover the 5% purchase commission and 5% sale commission if the stock were purchased at the current price.

In addition, for stocks you already own you will also see:

- Your Average Purchase Price: This is your average purchase price, excluding commissions.

- Your Breakeven Price: This is where the stock price has to be for you to recoup your purchase price, purchase commission (assumed at 5%) and sale commission as well.

- Your Real Gain per Share: This is how much you’ve actually made per share, taking account your purchase commission and your sale commission if you were to sell at the current share price.

- Your Real Total Gain: This is how much you’ve actually made in total, taking into account commissions for the purchase and sale and your average purchase price, were you to sell the price at the current share price.

Here’s a screenshot of my investment in e(BWANA):

To see this in action, visit your portfolio/lists at http://www.empireavenue.com/influencer/portfolio, then click on any stock to view the stats as you see them in the screenshot above. You can also see those stats if you visit a stock profile page. For profile pages of stocks you own, you’ll see your profitability stats.

It is very important to make sure you cover your purchase/sale commissions when you trade, otherwise you could very well sell a stock you think you’ve made money on, but you won’t be able to cover the 10.5% or so you’ll pay in commissions. Say what? Why 10.5%??? To calculate the gain, you can take 105% and divide it by 95%, which gives you a little over 110.5%. That 10.5% represents the gain from your purchase price that you need to cover your purchase and sale commissions.

If you make a hot buy that has a higher purchase commission, your break even is even higher. Unfortunately, neither the website or API (from what I can tell) provide any info on commissions you’ve paid in your transactions, so I have to assume you paid 5%. If you paid 30% commission and pay 5% on the sale, your pay back would be 36.8% above your purchase price (130% divided by 95%).

So do not be alarmed when you view a stock in your portfolio and my plugin says you currently have a loss. It’s because the stock hasn’t moved high enough to cover your commissions. However, if you have a stock that yields 1% dividends, your dividends will have covered your commissions in 11 days or so. In a future version of the extension, I want to account for accumulated dividends to get a true ROI calculation, which would be:

Sale Price – Sale Commissions – Purchase Price – Purchase Commissions + Accumulated Dividends

What Chris previously referred to as ROI (previous to the discussions I had with him), is actually dividend yield. ROI would be calculated as I have stated in my formula above, for investments currently being held. If I can get to a true ROI calculation that includes accumulated dividends, my extension will be that much better.

So, give it a shot and download the Empire Avenue Investment Analyzer Chrome extension download the P3 for Empire Avenue Chrome extension. Let me know what suggestions you may have by leaving comments here, or if you run into any bugs. Feel free to ask me any questions about investing on Empire Avenue as well, and I’ll be glad to try to answer them. Good luck and happy investing!

If you like my extension, feel free to show your appreciation and pick up a few shares of e(GEEKLAD).

AWESOME JOB MAN!!! I’m telling everyone about this. I knew you’d tear up Empire Avenue 🙂 🙂

Heh, thanks. 😀 It does remind me of the good old days of Blogshares.

Go to your portfolio here:

http://www.empireavenue.com/influencer/portfolio

then click on any stock to see the stats calculated as seen in the

screenshot above. I should have probably put that in the blog post. I’ll

update it with that info, great question.

You could also visit the profile page for any stock, for example:

http://www.empireavenue.com/GEEKLAD

Well done. This is very useful – and I love that you responded so fast.

Best ROBDICKINSON

Thx

e(BWANA) for this great plugin! 🙂

No problem, I hope it’s able to help you out. e(BWANA) is my good friend Bwana and I think a much better investment than me. Nevertheless, if you want to pick up a few of my shares as well, I’m

e(GEEKLAD)

Lots of people are asking me did I make this. LOL, NO!! I have NOT the skills!

LOL

I guess that’s what happens when your cartoon is posted all over the place on my site and on the extension page. Maybe I should change the screenshots to show my account. 😀

Thanks everyone for trying out my plugin. e(RINGLE) has incorporated my plugin into his P3 for Empire Avenue Chrome extension, so download it instead. Be sure to uninstall mine first, or weird things can happen. I’ll be putting any future enhancements in my algorithm into his plugin.

Amazing! Thank you so much!! Will promote & for sure will pick up your stocks, brains is always a superb investment! 😉

Jamie

(e)JLOH

Amazing! Thank you so much!! Will promote & for sure will pick up your stocks, brains is always a superb investment! 😉

Jamie

(e)JLOH

Amazing! Thank you so much!! Will promote & for sure will pick up your stocks, brains is always a superb investment! 😉

Jamie

(e)JLOH

Best Empire Avenue advice, outside of Chris Pirillo’s that I have read … thanks!

(e)WIND

Second time I’ve seen this mentioned today. May have to check it out.

Well written explanation, thanks : ) (e)RUBBERDRAGON but there are also other ways to earn eaves, by referring new members to EA and by picking up special offers such as Liking someone on FA in exchange for eaves?

Of course you will be aware of those methods and I’m wondering why you didn’t mention those?

it’s really great,thanks for sharing,I should have probably put that in the blog post. I’ll

update it with that info.

海量无水印高清美女任你看522222.net

Far too risky for me

http://www.Hound.com is gud medium for job seekers… its a amezing site everyone should try this site …

it help us to search job world wide n it is very convienient . in this sit e you did not need to search more just type your qualification and in which city do u want to do job thats it ……… it is not a advertising website it is just gather all the job seekers n n the employers at one place ….. it helps both the job seeker n also the employer.

leasing jobs</a

I found it very nice, thank you for this post. classificados